Lipper Fundmarket Insight Report Feb 2014

LAUNCHES, LIQUIDATIONS, AND MERGERS IN THE EUROPEAN MUTUAL FUND INDUSTRY, Q4 2013

Executive Summary

As of the end of December 2013 there were 31,724 mutual funds registered for sale in Europe. Luxembourg continued to dominate the fund market in Europe, hosting 8,617 funds, followed by France, where 4,797 funds were domiciled. For Q4 2013, 521 funds were created in Europe. During the same period 585 funds were liquidated and 337 were merged.

The results of the fourth quarter show that the industry still is consolidating its fund ranges. A total of 922 funds (585 liquidations and 337 mergers) were withdrawn from the market, while only 521 new products were launched.

View on the Mutual Fund Market in Europe

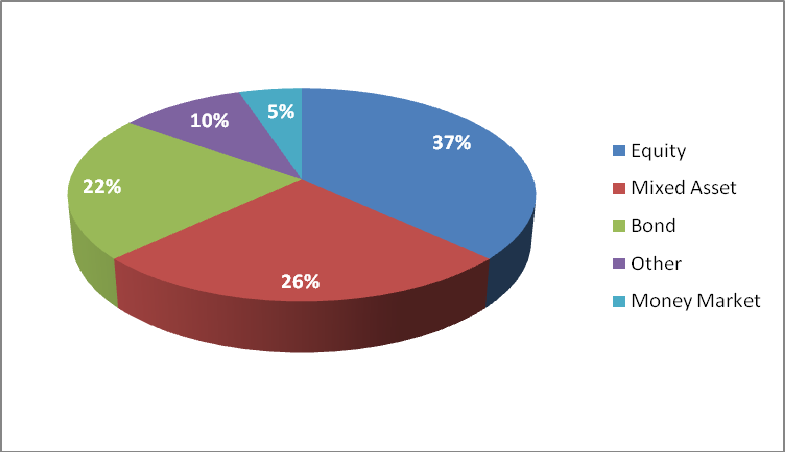

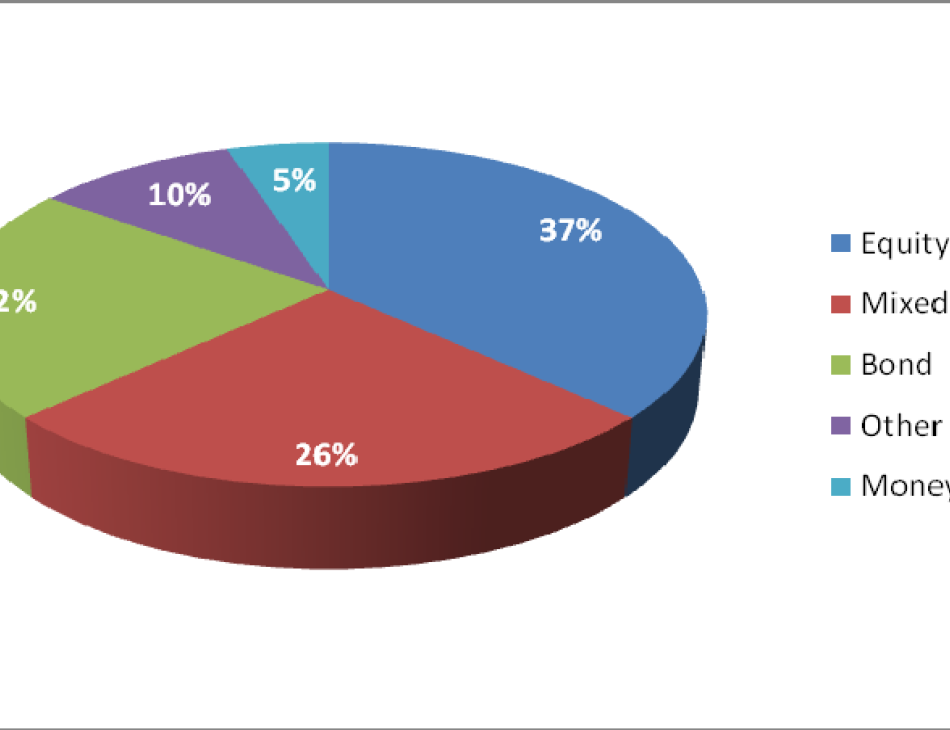

The chart below breaks down the European fund market by asset class as of the end of Q4 2013. Equity funds dominated the scene with 37% of the funds available for sale, followed by mixed-asset funds at 26%. Bond funds stood at 22%, while money market funds represented 5% of the market. The remaining 10% of “other” funds were real estate funds, commodity funds, guaranteed funds, and funds of hedge funds.

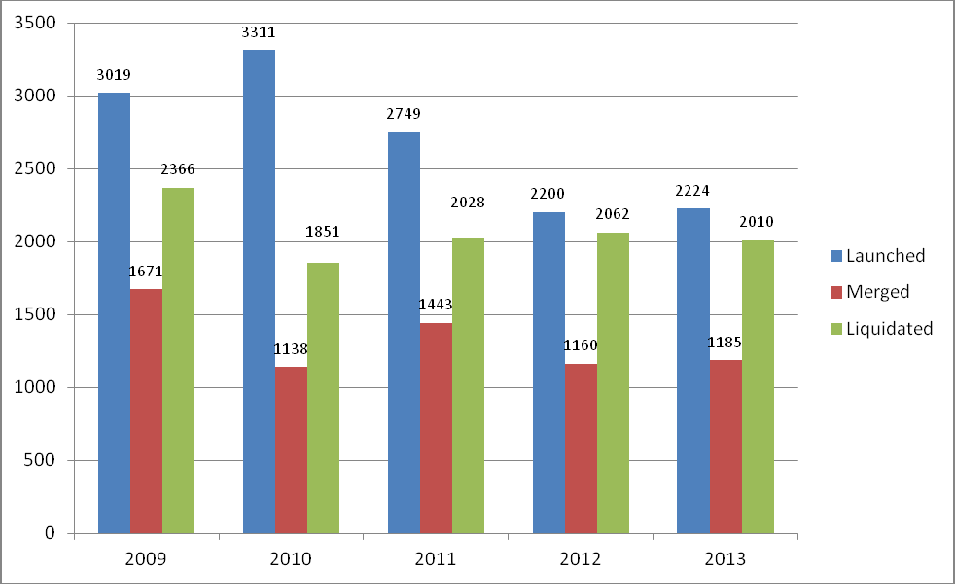

During 2013, 2,224 funds were launched in Europe. The quantity of newly launched funds for 2013 was nearly flat compared with the number of launches for 2012. Compared with the peak in 2010, the number of newly launched products for 2013 showed a decrease of around 33%.

The number of liquidations went down approximately 3%, comparing 2013 with 2012—to 2,010 from 2,062.

During the same period the number of fund mergers went up slightly—approximately 2%, from 1,160 for 2012 to 1,185 for 2013.

The trend of lower activity in setting up new funds we have noticed since the peak in 2010 has stopped; the industry launched a similar number of new products in 2013 as for 2012. The number of mergers and liquidations continued at a similar level, comparing 2012 with 2013. This might be an indicator of a successful revision of fund ranges, combined with common consolidation efforts.

Launches, Mergers, and Liquidations Over the Past Five Years

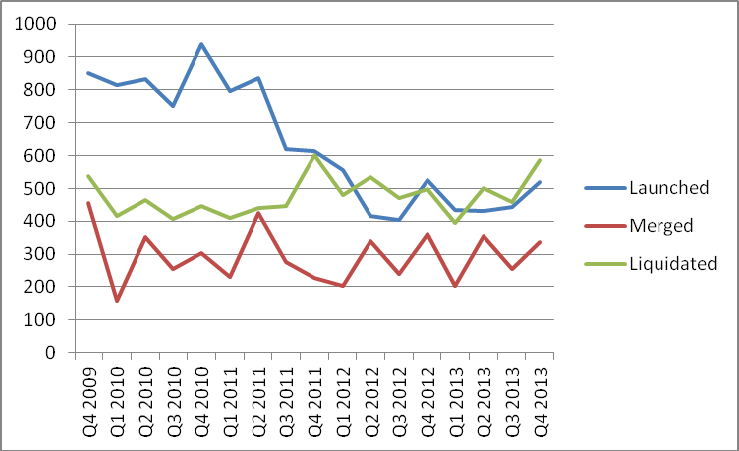

With 521 newly launched products for 4Q 2013, we noticed the highest number of new products for a single quarter since a year ago. Similarly, the number of liquidations and mergers went up, although the European fund universe still showed a negative trend in total.

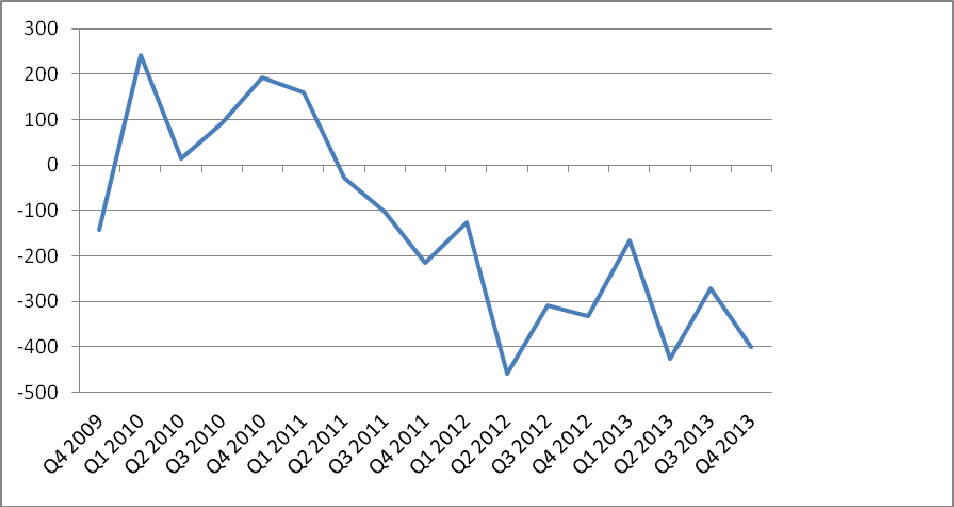

The net size of the European fund universe has decreased since Q2 2011. Q4 2013 showed a net decrease of 401 products.

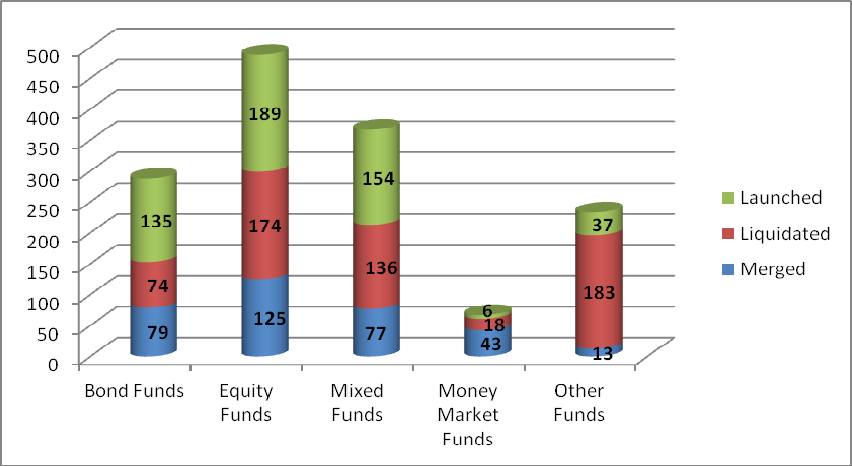

Changes in European Fund Universe Asset Classes, Q4 2013

Q4 2013 witnessed the launch of 521 funds: 189 equity funds, 135 bond funds, 154 mixed- asset funds, 37 “other” funds, and 6 money market funds. During the same period 585 funds were liquidated: 174 equity funds, 74 bond funds, 136 mixed-asset funds, 183 “other” funds, and 18 money market funds.

For Q4 2013, 337 funds were merged: 125 equity funds, 79 bond funds, 77 mixed-asset funds, 13 “other” funds, and 43 money market funds.

The net changes for Q4 2013 showed a split picture. With the net change for money market funds showing 61 closed against 6 launched and “other” funds showing 196 closed against 37 launched, we saw a significant negative trend for these sectors in total. On the other hand, we saw the bond and mixed-asset sectors also have negative net numbers, but with 153 closures against 135 launches for bond funds and 213 closures against 154 launches for mixed-asset funds the picture there was significantly better.

Outlook

Increasing regulatory demands will lead to higher costs for the fund management industry. Since not all of these costs can be passed on to investors, the industry will face further pressure on margins. In addition, a number of asset managers are under pressure in terms of profitability requirements from their parent companies. In this regard, we might see a further shrinking in the number of funds as fund promoters continue to restructure their product ranges. These restructurings may be seen in terms of strategies offered and/or distribution platforms (local versus international) used in this environment of increasing costs, shrinking margins, and demand for profitability.

All of this does not mean the industry will face a lack of innovation, since investors still expect new and innovative products. But the launch of new products might become more demand- than market-driven in the future. So, the industry may stay in a consolidation mode but will continue to launch new and innovative products.

DETLEF GLOW

Head of Lipper EMEA

Research

CHRISTOPH KARG

Content Specialist for

Germany & Austria