Lipper’s November European fund flow trends

Equities are favoured by European investors:

The European mutual fund industry, with overall net inflows of €12.7bn for long-term mutual funds, showed a healthy growth pattern for November 2013. As in the previous month money market products suffered net outflows for November (-€11.7bn). The inflows were mainly driven by inflows into equity funds (+€9.8bn) and mixed-asset funds (+ €4.8bn) as well as into property products (+€0.4bn). “Other” (-€1.5bn), commodity (-€0.3bn), and hedge funds (- €0.3bn) as well as bond (-€0.2bn) products showed net outflows.

Over the course of the year 2013 so far the European fund industry enjoyed net inflows of €177.2bn, driven by net inflows into bond funds (+€95.8bn), equity funds (+€95.7bn), and mixed-asset funds (+€79.1bn). In contrast, money market funds showed the highest net outflows (-€86.3bn).

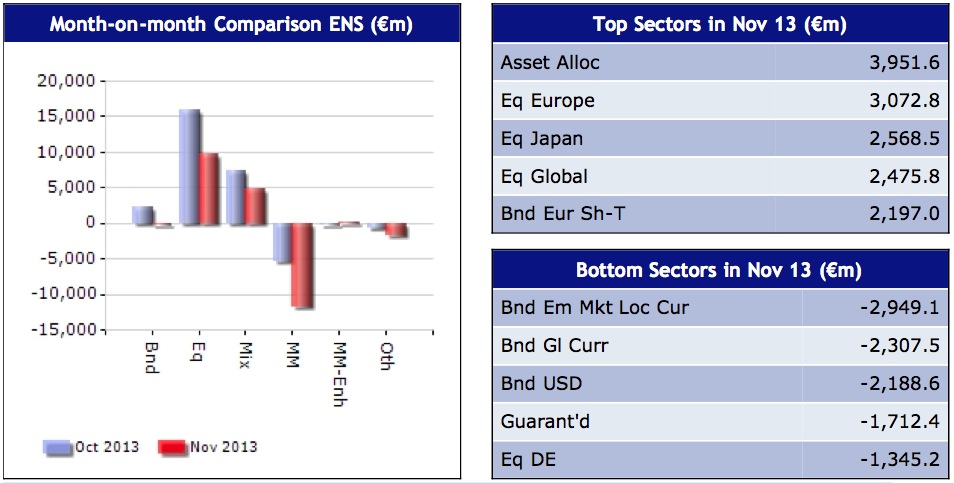

Following the sales pattern for long-term funds, asset allocation was the most popular fund asset class for November (+€3.9bn of net inflows), followed by equities Europe (+€3.1bn) and equities Japan (+€2.6bn) as well as equities global (+€2.5bn) and bonds EUR short-term (+ €2.2bn). At the other end of the spectrum bonds emerging markets suffered net outflows of around €2.9bn, bettered somewhat by bonds global currencies (-€2.3bn), bonds USD (-€2.2bn), guaranteed funds (-€1.7bn), and equities Germany (-€1.3bn).

Early indicators for December activity:

While the focus of this report is to summarise comprehensive data on mutual fund flows across Europe for November 2013 (see above and over), there is also an opportunity to provide some early indicators of provisional flows data for December. Looking at Luxembourg- and Ireland-domiciled funds, money market funds—with projected net inflows of around €2.3bn—might see a new dawn. Bond funds show estimated net inflows of €3.7bn. Also, equity and mixed-asset funds’ sales should remain positive, with estimated net inflows of around €7.1bn and €4.6bn, respectively. Even though these numbers are estimates, it seems equity and mixed-asset funds are in European investors’ favour.

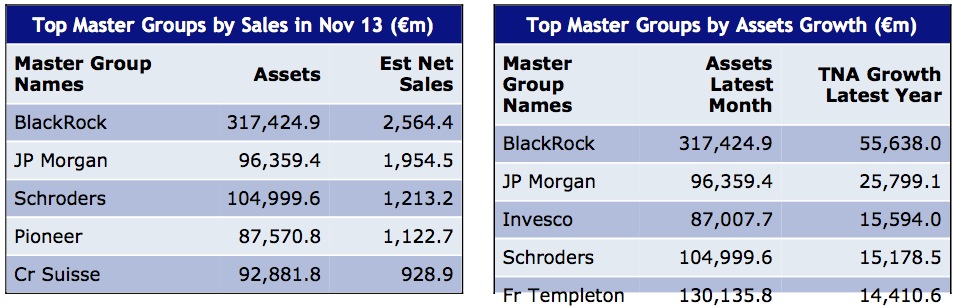

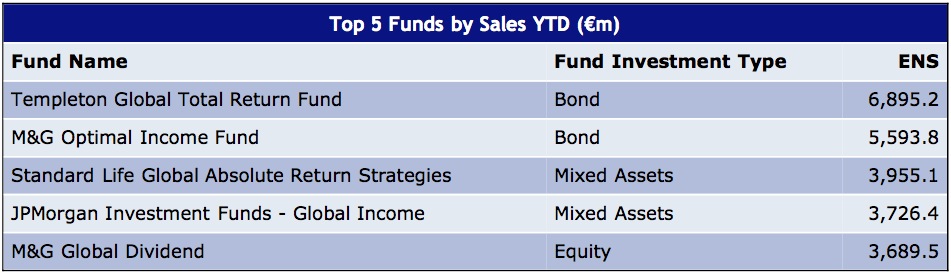

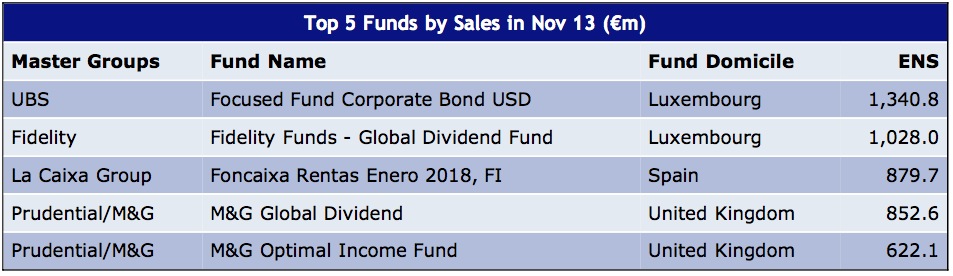

Note: charts and rankings on this page exclude funds of funds and money market funds. ENS=Estimated net sales. TNA=Total net assets.

NOVEMBER IN BRIEF:

The European funds industry enjoyed net inflows of €12.7bn for November 2013, bringing the estimated net inflows for the year-to-date period to €177.2bn.

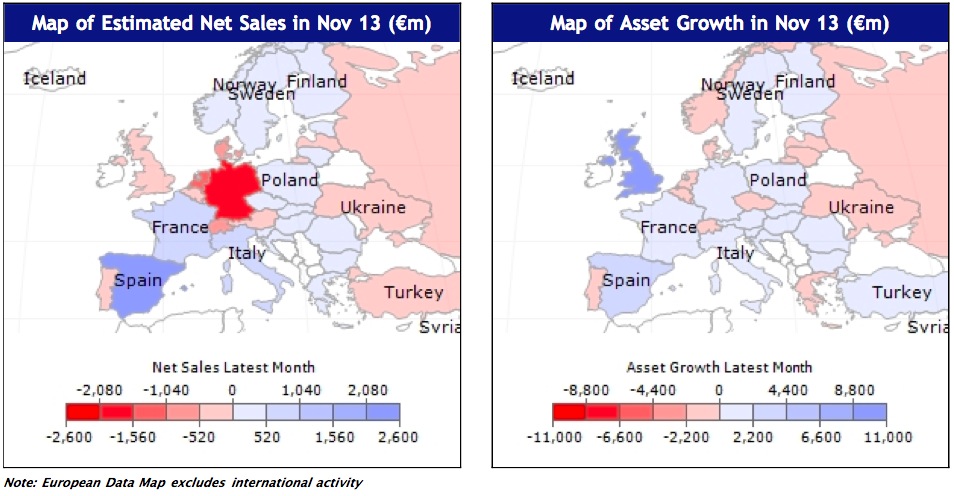

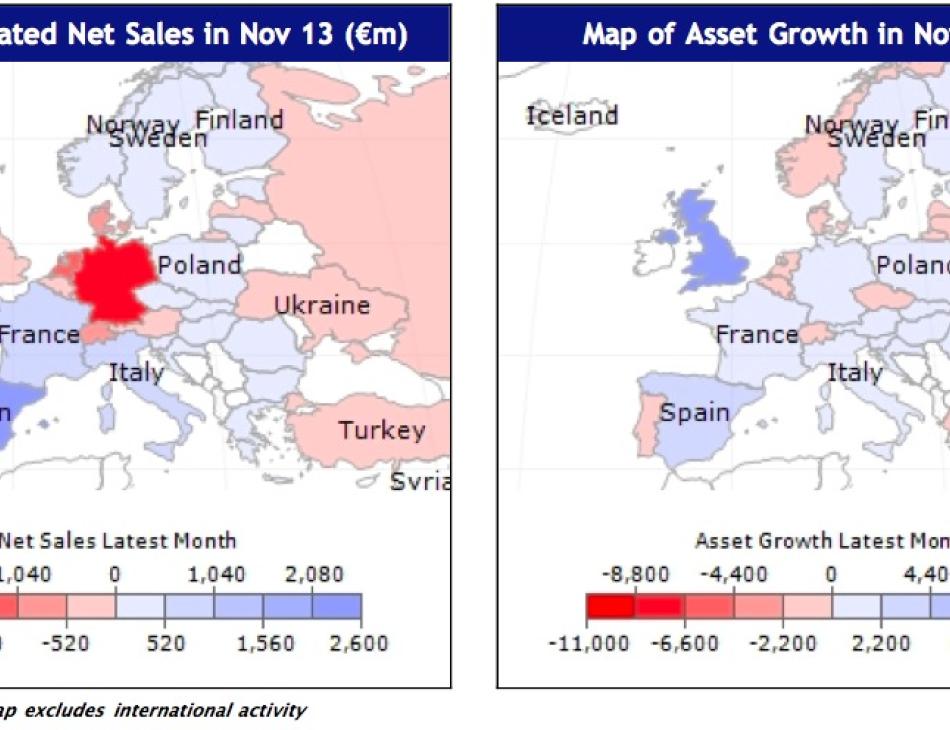

Single fund market flows for long-term funds showed a mixed picture for November, with Spain (+€2.6bn), France (+€0.8bn), and Italy (+€0.7bn) leading the table. Meanwhile, Germany (- €1.8bn), the Netherlands (-€1.5bn), and Denmark (-€0.8bn) stood on the other side.

Even as equity and mixed-asset funds showed impressive net inflows for November, bond funds—with estimated net inflows of €95.8bn—remained the best selling asset class for 2013 year to date.

BlackRock was the best selling group of long-term funds for October, with net sales of €6.8 bn, ahead of JP Morgan Asset Management (+€2 bn) and Schroders (+€1.1 bn).

Provisional December figures for Luxembourg- and Ireland-domiciled funds suggest that bond funds, with estimated net inflows of around €100bn, will be the best selling asset class for 2013

Detlef Glow, Head of EMEA research