Thomson Reuters Lipper European Fund Industry Review—H1-2017

Executive Summary

2017–New Records Ahead for the European Fund Industry?

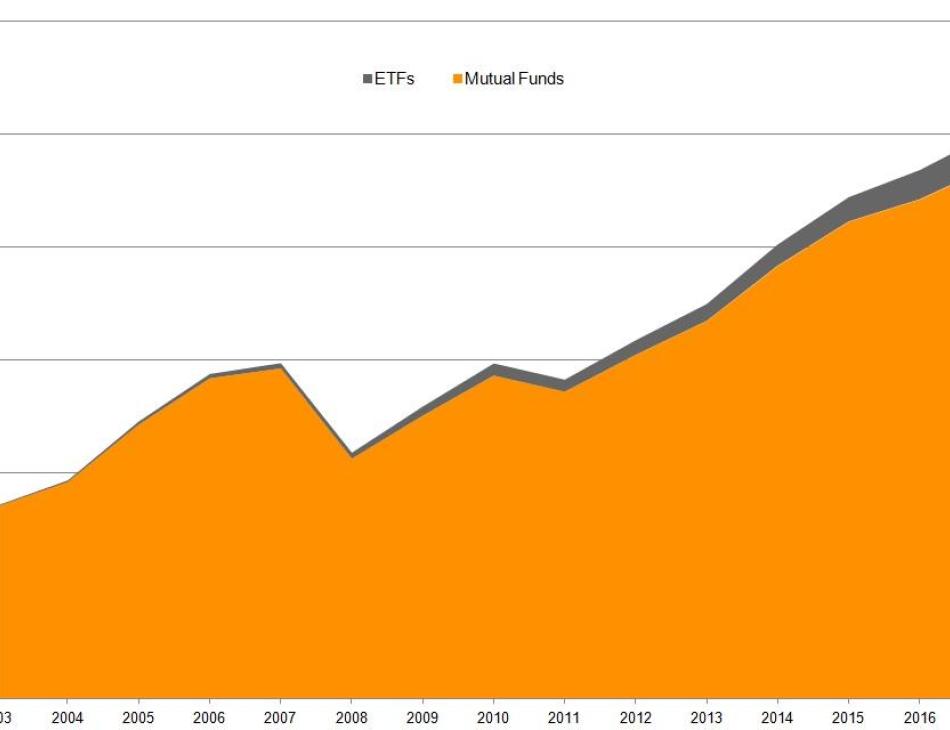

The assets under management in the European fund industry increased from €9.4 tr to €10.0 tr over the course of first half 2017.

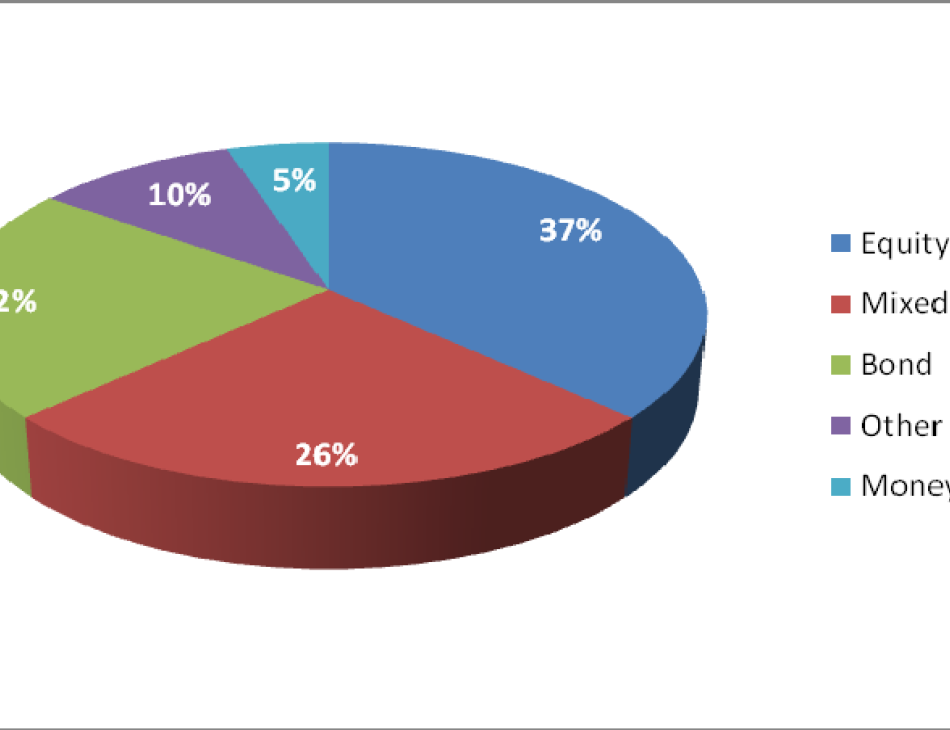

Bond funds (+€161.3 bn) were the best selling asset type for 2017 to date.

Within the segment of long-term mutual funds Bond Global (+€36.9 bn) was the best selling sector, followed by Equity Global (+€26.5 bn) and Bond Emerging Markets Global in Hard Currencies (+€20.7 bn).