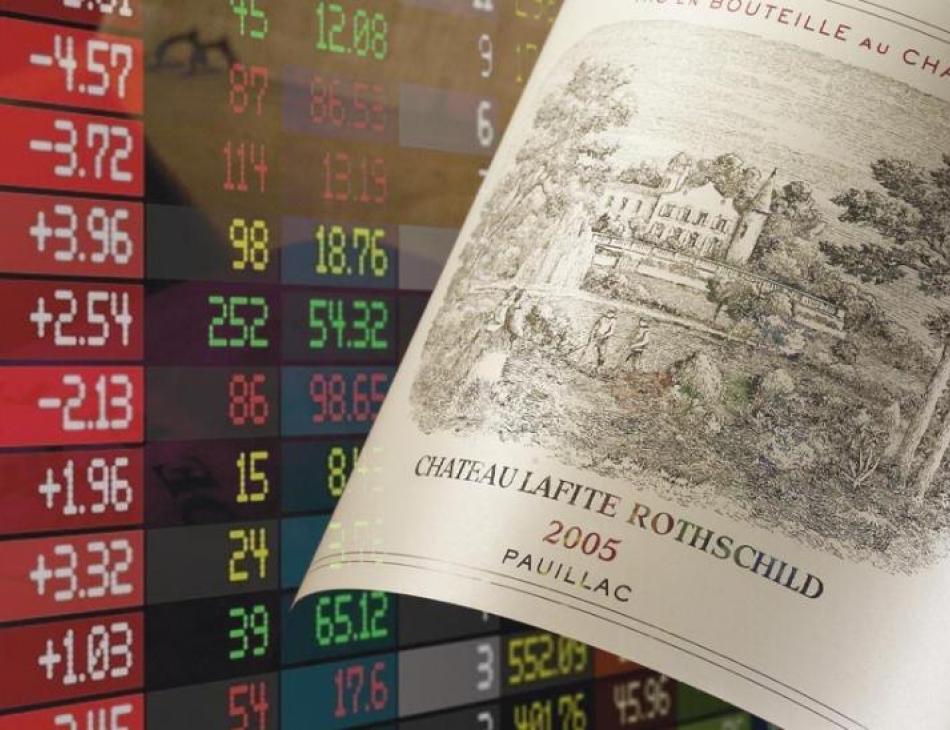

Fine Wine Investing: Amid Market Turmoil Does This Alternative Asset Class Merit Consideration?

As the Coronavirus continues to spread rapidly at the time of writing mid this March, the full scale of the risk to the global economy has hit markets with rarely seen violence. The speed of the sell-off in equities and “risky” asset classes has only been matched by the rise in price of safe haven assets such as U.S. government bonds (Treasuries) or gold.

Now cash has suddenly become King and riskier asset classes shunned - at least for now. Who would have thought this just a few months ago? We certainly live in volatile and risky times.